Rachel Reeves’ plan to significantly increase borrowing in the Budget risks driving up mortgage rates, Treasury analysis suggests.

The Chancellor’s plans to rewrite the UK’s fiscal rules could increase the cost of debt for consumers and businesses, an official modeling study shows.

The Treasury research paper warns that “fiscal easing” of just one per cent of GDP could lead to a “peak increase in interest rates” of up to 1.25 percentage points.

The document warns that every £25bn increase in annual borrowing could raise interest rates by 0.5 to 1.25 percentage points.

Ms Reeves is expected to use the October 30 Budget to ease borrowing rules; The move could pave the way for up to £50 billion in spending.

Treasury sources confirmed that the policy document titled “The Impact of Borrowing on Interest Rates” published in December reflects the Ministry’s current thinking.

This comes at a time when mortgage rates are cooling, with some deals falling below 4 percent for months.

Central interest rates currently stand at 5 per cent but an increase to 6.25 per cent would add around £200 per month to a typical mortgage.

Former Chancellor Jeremy Hunt said on Saturday night: “The consistent advice I have received from Treasury officials has always been that increased borrowing means interest rates will be higher for longer, penalizing families with mortgages.

“This would be a huge blow and lead to mortgage distress for many people, at a time when the Bank of England is expected to cut interest rates again.”

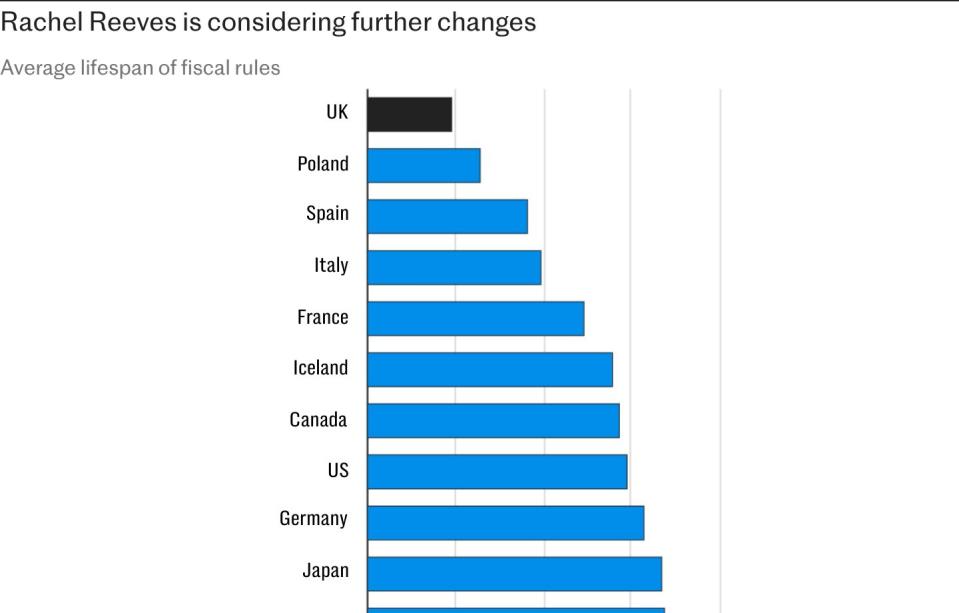

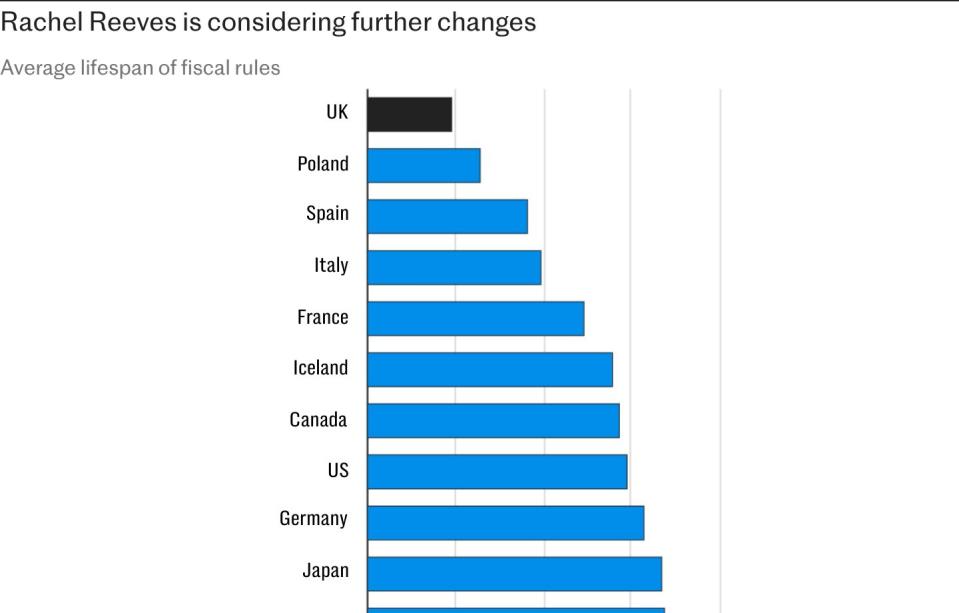

Mr Hunt called for the Office for Budget Responsibility to be legally obliged to publish a full analysis of any changes to fiscal rules. Britain’s debt recently rose to 100 percent of gross domestic product for the first time since the 1960s.

Despite this, Ms Reeves gave the strongest hint on Saturday that she intends to raise borrowing to fund a multi-billion pound capital programme, vowing to “invest, invest, invest”.

It follows warnings from Sir Keir Starmer that his party’s first budget will be “painful” and that the Chancellor is expected to raise some taxes in a bid to plug the £22bn black hole he claims to have found in public opinion. finance.

It is thought this could include a raid on capital gains tax, inheritance tax or pension tax.

Some of the effects of higher debt have already been “priced in”, economists said. When markets closed on Friday, the yield on the 10-year bond was at 4.13 percent, its highest level since the end of July; This partly reflects concerns that Ms Reeves intends to increase borrowing in the Budget.

But the Institute for Fiscal Studies (IFS) has also warned that Ms Reeves’ “opportunistic” attempt to game Britain’s fiscal rules risks causing a rise in interest rates.

The think tank said any move to change the Chancellor’s self-imposed fiscal rules “would not be without risk” and borrowing an extra £50bn in 2028-29 could have a “material impact on interest rates”.

IFS deputy director Carl Emmerson said: “If you borrow too much, you run the greater risk of interest rates correspondingly being higher. “One of the lessons for Rachel Reeves is to be careful about borrowing because of the risk to interest rates.

“Some will have savings and will incur higher interest rates on their savings. “The real risk you’re going to worry about is people’s mortgages being a little bit more expensive.”

Mr Emmerson added that the impact on mortgages would depend on the extent to which additional borrowing was used to fund “current” or “capital” expenditure.

“If you inject money into an economy, there’s more cash floating around, which can cause inflation and the Bank of England responds with higher interest rates. This will happen if they see a budget being handed out that they don’t think will be beneficial to the supply side of the economy,” he said.

“But if you make some investments that will encourage the private sector to invest, improve the growth rate and increase the productive capacity of the economy, then you won’t have the Bank of England’s concerns that this is inflationary and will lead to higher interest rates. “There is a need.”

The Treasury’s analysis does not take into account measures with “supply-side benefits” and notes that the impact on interest rates would be smaller “where these policies provide a material benefit to the supply side”.

Official advice from the Treasury warns that “an unexpected increase in spending financed by additional government borrowing or a tax cut will increase the level of demand in the economy, thereby increasing inflationary pressures, which could lead to inflation.” “We aim for the Central Bank to increase interest rates.”

A Treasury spokesman said: “This analysis makes clear that the relationship between fiscal plans, inflation and interest rates is complex and can change significantly over time. The Chancellor has repeatedly said he will not play fast and loose with the public finances and will protect working people.”