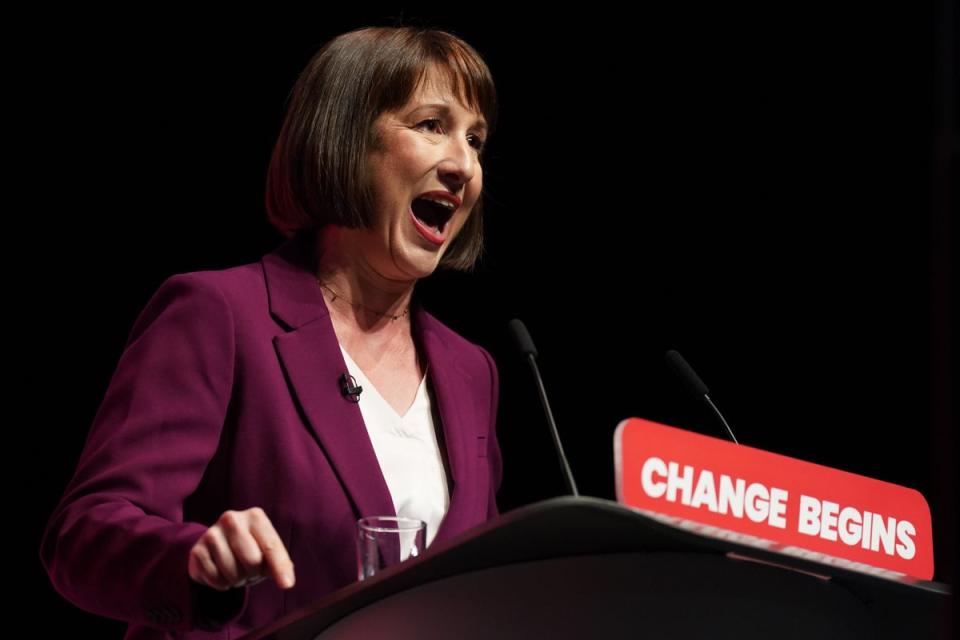

Rachel Reeves will announce Labor’s first budget in 15 years on October 30, as speculation grows about what measures might be included.

The Chancellor faces a difficult task as the financial episode takes shape against the backdrop of the £22bn ‘black hole’ in public spending he announced in late July.

Prime Minister Sir Keir Starmer likewise warned that the financial crisis would be “painful” but that “given the situation we are in there is no other option”.

Many experts take this to mean that tax increases are on the horizon, along with possible spending cuts. But with an absolute determination not to increase income tax, national insurance or VAT (the three biggest sources of revenue), the chancellor will need to look elsewhere to raise vital revenue.

The Institute for Fiscal Studies said he had a difficult task ahead of him as he “left himself little room for manoeuvre”.

“Many of the tools best suited to the task of raising significant revenue have been made inaccessible,” added IFS economist Isaac Delestre.

In light of this, Ms. Reeves’ announcement is likely to be lengthy and introduce smaller changes and adjustments that, when put together, could make a big difference.

Here’s your guide to some of the announcements the Chancellor might consider making in his first budget.

Capital Gains reform

Capital Gains Tax (CGT) is payable on the profit made from selling an asset that has increased in value. It applies to things like the sale of personal effects valued at more than £6,000 (excluding cars), property that is not the seller’s main home, shares and business assets.

Basic rate taxpayers are charged 10 or 18 per cent, and higher or additional rate taxpayers are charged 20 or 24 per cent. There is a tax-free allowance of £3,000.

There are several ways CGT can be changed. Ahead of the election, the Liberal Democrats and Greens said they would rethink tax bands to be more similar to income tax, raising an estimated £5.2bn a year.

Taxation of retirement savings

Pension tax reduction is the reduction of the amount of tax paid on private pensions. It helps employees save for retirement by increasing their retirement pot.

The amount of tax relief available to a person depends on their income tax. Tax on pension contributions up to a maximum of £60,000 will effectively be cancelled.

From now on, contributions will be taxed at 20, 40 or 45 percent, depending on which income tax rate the employee is under.

But the chancellor is thought to be considering a flat pension tax relief rate of 30 per cent. This means that high-income earners will effectively pay a 10 percent tax, while those who benefit from the additional rate will pay 15 percent.

The measure will raise around £3 billion a year and 7 million income earners will pay more tax. But this would be better news for basic income earners, who would start receiving a 10 percent increase in their pensions.

The IFS, which considered the idea last year, said it would “redistribute the tax burden from the bottom 80 percent of income earners to the top 20 percent.”

Inheritance Tax reform

Inheritance tax is a tax levied on the estate of a deceased person. This is their property, their money, their possessions. Importantly, these items are not paid if they are worth less than £325,000.

The tax rate is 40 percent, but it is collected only on the portion of the property above the threshold. Just 5 per cent of deaths in 2023/24 led to an inheritance tax bill of around £7bn.

But the tax measure is “full of special exemptions,” the IFS writes. These include commercial convenience, tax-free transfer of agricultural lands and tax-free transfer of pensions.

The economic think tank says ending these measures alone would raise £4.8bn a year by 2029.

Cuts in welfare spending

Labor has made no secret of its desire to reduce the government’s welfare spending bill, so Ms Reeves is likely to use the Budget as an opportunity to do so.

Speaking at Labour’s party conference, the prime minister said: “We will cut the welfare bill because we will tackle long-term illness and support people back to work.”

What has been confirmed is a crackdown on benefit fraud aimed at saving £1.6bn over the next five years. Also possible is the mooted reform of personal independence payments (PIP) to provide cash vouchers or expenses rather than regular payments, a Conservative-era policy that Labor has refused to reject.

Fuel Tax increase

Fuel duties or taxes apply to the purchase of gasoline, diesel, and various other fuels used in both vehicles and home heating.

The level of fuel duty depends on the type of fuel used, with fuel duty on a liter of petrol, diesel, biodiesel and bioethanol being 52.95 pence. After being frozen at 57.95p since 2011, it will be cut by 5p in 2022 by the Conservatives.

According to the Office for Budget Responsibility, this represents a significant source of revenue for the government and is expected to generate £24.7bn in 2023-24; This corresponds to 2.2 percent of all revenues.

Canceling the 5 per cent cut would save the government an estimated £2bn. But doing so won’t automatically force fuel retailers to lower their costs, which will likely mean higher fares for drivers, at least in the short term.

Business Rates reform

In its election manifesto, Labor said it was committed to reforming the current business rates system “so that we get the same income more fairly”.

What this means was not explained by the party, but it said the new system would be designed to “level the playing field between the high street and online giants, better encourage investment, tackle vacant properties and support entrepreneurship”.

It is thought this could take the form of a sudden cut in rates, while also closing loopholes that have allowed some firms to avoid the tax. This will come as welcome news for small business owners, but Labor will be careful to ensure its reforms protect monetary net zero.

Chancellor of the Exchequer James Murray MP confirmed this at an event outside the Labor Party conference hosted by the British Retail Consortium, saying: “It’s within the existing framework. “The important thing is to raise the same amount of money in total, that is the commitment.”

Private equity profits

In another manifesto pledge, Labor said it would reveal more details about plans to close the private capital tax loophole in the October Budget.

Due to the ‘carried interest’ law, private equity fund managers pay only 28 percent tax on their income treated as capital gains. This was the result of a successful lobbying campaign in 1987.

Labor has promised to change this by making managers pay a 45 per cent higher rate of income tax. It is estimated that the change will raise around £600 million a year and only a few thousand people will be affected.